3 different ways to calculate Equity risk premium for India

One of the most popular ways to value a listed company is to run a discounted cash flow (DCF) valuation. For this method, you estimate the future cash flow of a company and discount them back to the present using a discount rate. This discount rate known as Cost of Equity or Cost of Capital is calculated usually using a model called CAPM and one of the most important variables of the model is the Equity Risk Premium.

The equity risk premium is the excess return above the risk-free return that you expect by investing in the stock market. It is premium for the risk that you take. Another way to look at it is the minimum return over a risk-free asset that you would expect from a stock.

Before we dive into calculating equity risk premiums we need to know what is a risk-free asset. Usually for an asset to be risk-free it should be free of

Reinvestment Risk

Default Risk

Now, a 10 Year Government Bond of India, will be free of reinvestment risk for the most part. However, it is not free of default risk. Moodys and S&P both give rankings to countries according to their risk, and India is far from Triple-A. This means that it carries default risk and that needs to be incorporated to calculate the real risk-free rate.

One can you sovereign CDS Spreads to back out the probability of default for a country. Aswath Damodaran has used the Moody's country ratings to come up with a table (which is updated regularly) that gives us an idea of the country risk or the sovereign bond default risk.

Once we have this number we need to subtract it from the 10-year bond to get a real risk free rate. So for example, if the Indian 10-year bond is giving us 6.2% and the probability of default is 1.5% then the real risk-free rate is 4.7%.

Now that, we have clarified the risk-free rate calculations let get into the three different methods you could look into to calculate the equity risk premium for India.

1. Historical Equity Risk Premium

This is the most common method that is used to estimate the Equity Risk Premium. In this method, you look at the historical return given by stocks and risk-free assets. You take the difference and you arrive at an equity risk premium.

(Stocks Expected Return - Real risk-Free Rate) = Equity Risk Premium where the expected return is similar to historical return.

The problem with this method is that it gives a historical risk premium and not a forward-looking premium. The Equity risk premium will change depending on how far you go in history and hence you could have multiple answers depending on the data you use. Furthermore, it may not be an accurate reflection of risk in the equity market at that period.

Another common method that uses present data is to use the earnings yield which is the inverse of the PE ratio. However, that may not work in India.

2. Implied Equity Risk Premium (Aswath Damodaran Method)

The method above estimates a historical equity risk premium. A better method could be to estimate a forward-looking equity risk premium. This is a method Professor Aswath Damodaran uses to calculate the equity risk premium. You basically will use the two-stage Gordon Growth model to try to figure out the risk premium.

The Gordon Growth model has a few important inputs that are used to estimate the price of the stock. You need the

Dividends Paid

Growth Rate for regular and terminal phase

Cost of Equity

So now what you do is that you take the current price of the index as the intrinsic price of the index. You have the growth rate and the dividends paid. Now, all that you do is solve for the cost of equity and hence you end up with the equity risk premium. This can be carried out in Excel using the goal seek function.

Here is a video of Professor Damodaran explaining the same and here is a video of him showing how to calculate it on his Excel Spreadsheet. He calculates and posts this number every month on his website.

Now as the dividend payout ratio for India is very low, it is better to calculate the equity risk premium for the USA and then add India's country risk premium to it. To do this though you need to calculate India's country risk premium for equities.

This is quite easy. You will need

India's Default Probability on Sovereign Debt

Standard Deviation of Equities

Standard Deviation of

We have talked about finding the default probability at the start of the article. Then you simply need to apply everything into the formula -

In case the image is unclear it is - Default Risk on debt*(Standard deviation of Equities in India / Standard Deviation of Bonds in India)

This gives us India's country risk for equities. We simply need to add this to the US Equity Risk Premium. Now if we get 3% as India's Country Risk premium and 5% as the US ERP then India's Equity risk premium will be 8%.

3. Corporate Bond Spread

Just like Equities, even bonds have had a risk premium. Corporate bonds have higher yields than Treasury bonds as they are riskier. The difference is the spread which can be looked at as a risk premium. The BAA Corporate Bond Spread is available on Fred and it gives you an exact number for the risk premium which BAA bonds are getting.

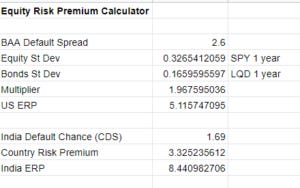

For example, as of August 3rd, 2020, the BAA Spread is 2.58. We need to convert this premium to the equity premium. We can try to do this by looking at standard deviations. If we take the standard deviation for the SPY(US index) and the LQD(Investment Grade Corporate Bond ETF) we get 0.327 and 0.166 respectively giving us a multiplier of 1.96(0.327/0.166). So then we multiply the same with 2.58 to get a rough estimate of 5.07(2.58*1.96) as the ERP for the US.

Now that we have an Equity Risk Premium for the USA, we simply add India's country risk premium, the same way we do in the 2nd method. Once we add that as of August 20th, the equity risk premium was close to 8.5.

This method relies on the principle that risk in both the equity and bond markets usually increases together and hence if we know the bond risk premium we can attempt to estimate the equity risk premium. It is far from perfect but it does the job on most occasions.