A quick look at the business of Ferrari

Side Note - Does Ferrari have the coolest stock ticker ever? - RACE

In 2022, close to 85.4 million motor vehicles were shipped worldwide. Of that total, only 13,221 were Ferraris. Talk about scarcity!

It's clear as day that Ferrari is more than just an automobile company; it's a luxury brand. After all, you aren't buying a Ferrari to "commute."

The car business

About 85% of Ferrari's revenue comes from selling cars. The rest? Well, they make money by providing engines for Formula 1 and doing all sorts of fun stuff under the Ferrari brand umbrella, like selling gear and running theme parks like the one in Abu Dhabi.

Currently, Ferrari divides its cars into four categories. Range, Special series, Icona and Supercar. In 2022 close to 96% of the units shipped belonged to the Range category.

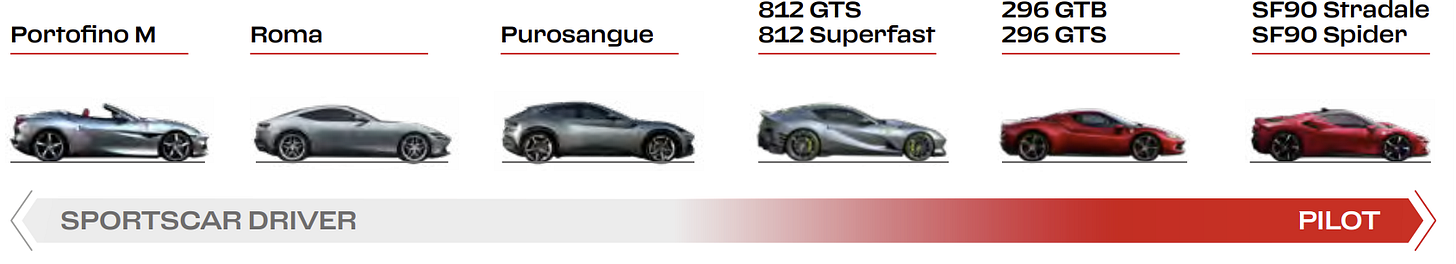

Ferrari further divides their target clients into two categories:

The "Sports Car Driver” - This profile of customer is seeking an elegant and understated design for driving a car in various locations and conditions, either alone or with passengers, and using their Ferrari for longer journeys;

The Pilot - This profile of customer is in search of a high-performing and extreme sports car for driving on tracks and challenging roads, aiming for an exhilarating driving experience.

When it comes to production, Ferrari has two production facilities, both situated in Italy (Maranello and Modena). All of its cars are crafted in Italy, where it operates at nearly full capacity, producing around 14,000 units.

Ferrari is also building a new factory in Maranello to produce electric supercars and next-generation powertrains. The plant is scheduled to open in 2024 as Ferrari is planning on releasing its first fully electric supercar in 2025.

Some History

Ferrari's story starts back in 1929 when Enzo Ferrari set up the Scuderia Ferrari racing team as part of Alfa Romeo. It was basically a place for Enzo to try stuff. Fast forward to 1947, and Enzo decides to kick things up a notch by creating Ferrari S.p.A, the real deal car company. That same year, they roll out their first road car, the 125 S.

Right out of the gate, the 125 S nails its first victory at the Grand Prix of Rome. That win was just the start of Ferrari's domination on racetracks everywhere.

In 1960, Ferrari decided to go public. For over 50 years, they were part of the Fiat family, but in 2016, they decided to do their own thing and broke off from Fiat.

The Exclusivity

Buying a Ferrari can indeed be a bit of a headache. Now, that might sound obvious considering you are basically emptying your wallet, but it's not just about the money.

Take late-night talk show host Jay Leno, for example.

He boasts a collection of 180 cars but not a single Ferrari. Why? Because buying a Ferrari isn't about strolling into a showroom and driving off in your dream car.

Ferrari operates by what seems like the "cool club" rule. You're not just a buyer; you're a member of an exclusive club. And getting in isn't easy. You'll likely have to wait a couple of years just to get your foot in the door. And even when your turn finally comes up, it's unlikely you'll get the exact Ferrari that you want. You might have to settle for a base level model. Then, to top it off, you might need to buy a couple more before you finally get the chance to lay your hands on the Ferrari of your dreams. With demand for Ferraris far exceeding the available supply, it's no surprise that Ferrari dealerships might come across as a tad bit arrogant.

Oh, and let’s not forget Ferrari is not afraid to sue.

Sued customers for modifying cars? Check.

Sued a charity? Check

Sued a Customs Administration? Check

As mentioned in their annual report “We are fiercely protective of our brand, which is among the most iconic and recognizable in the world and is critical to our value proposition to all of our stakeholders”

Porter’s Five Forces?

Threat of New Entrants: Low: The automotive industry requires significant capital investment in manufacturing facilities, research and development, and marketing. Additionally, the prestige and history associated with a brand like Ferrari creates high barriers to entry for any new competitor.

Bargaining Power of Suppliers: Moderate: Ferrari sources components and materials from a select few suppliers. Given the rarity and precision required for some of these components, Ferrari must be highly selective, resulting in the moderately high power for these "selected suppliers."

Bargaining Power of Buyers: Low: Don't think this needs further explanation.

Threat of Substitute Products: Low to moderate: Passenger cars have various substitutes among transportation modes such as buses, trains, planes, etc. However, when it comes to super luxury cars, they serve as status symbols rather than mere transportation tools. Not a lot of substitutes.

Intensity of Competitive Rivalry: Moderate: While there are other luxury and high-performance automotive brands in the market, Ferrari's unique blend of heritage, engineering prowess, and racing pedigree creates a strong differentiator.

Some final thoughts?

I don’t want to get too deep into the numbers and so will highlight just three metrics.

Gross Profit Margin - Close to 50%

EBITDA Margin - Close to 35%

Return on Equity - Greater than 40%

Pretty crazy numbers for an automobile company. I think the more interesting question is “How will the company grow & can they do so while maintaining this profile?”

Well, to start with, Ferrari is not a 10-year story. It's a brand that has lasted more than 75 years and will quite possibly last another 75. Rather than super high short-term growth, it's a long-term growth story.

Having said that, they are expanding production facilities, as we speak. Another interesting growth driver is customization. All Ferrari models feature highly customizable interior and exterior options. Stuff like carbon fiber parts, titanium exhaust systems, alternative brake caliper colors, parking cameras, etc.

As the image above shows, they have different level of customization options.

When thinking ahead, it will be fascinating to witness how consumers embrace and adapt to the idea of an electric-powered Prancing Horse.

PS - This is not meant to be investment advice. I don’t track the stock and am just interested in the business.

Thanks for reading.