How to calculate the PE ratio of a zero growth stock?

In the Graham formula, Benjamin Graham calculates the PE ratio of a stock with zero growth. He estimates the same to be 8.5. (EPS*((8.5+2G)However he calculated this long ago, and times have changed since then. This article shows you, (or atleast attempts to) how you too can calculate a PE ratio for a non-growth stock.

A non-growth stock is a stock that will grow by 0% or display no growth In the future.

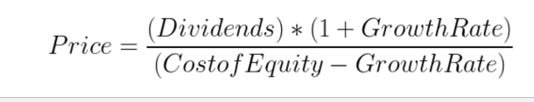

The basic principle for this calculation starts with the dividend growth model. The formula for the model is shown below.

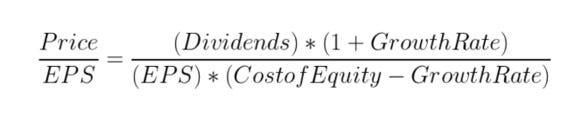

Divide both sides by EPS.

We know that Price/EPS = PE Dividends/EPS = Dividend Payout Ratio.

Replacing that in the equation we get

Now we look into the sustainable growth rate formula. Growth = Return on equity*(1- dividend payout ratio) Doing some algebra in that equation we get - Dividend Payout Ratio = 1 - (Growth Rate/ Return on Equity) We replace that into the equation -

Finally now we plug in 0 for growth as we are calculating the PE ratio for a company with zero growth.

The price to earnings ratio for a company which is not going to grow in the future (zero growth) will be 1/ Cost of Equity, if we use the Dividend Growth Formula.

Now the question is what will be the cost of equity. Most people use the Capital Asset Pricing Model (CAPM), I leave that to you. I have attached a table below which should make the calculations easier. Cost of Equity Zero Growth PE ratio 4% 25 5% 20 6% 16.66666667 7% 14.28571429 8% 12.5 9% 11.11111111 10% 10 11% 9.090909091 12% 8.333333333 13% 7.692307692 14% 7.142857143 15% 6.666666667 16% 6.25 Whatever the cost of equity you calculate, the corresponding value should be its non growth PE ratio. Some of the applications of this can be seen in the Graham formula. For example instead of using the 8.5 which Graham calculated you can now incorporate your cost of equity calculations into the formula. For example, if you estimate the Cost of Equity for a stock to be 14% then the corresponding non growth PE ratio will be 7.14%.

This can also be used to improve the usage of the famous PEG ratio.