Investing principles to live by

A gentle reminder of the obvious

As you delve deeper into the realm of investment literature, you may find yourself surrounded by an abundance of quotes and ideas that may seem like common sense. However, as you read and reread those timeless texts, you will realize that while the principles may sound simple, putting them into practice is far from easy.

In fact, the more you read and invest, the more you will appreciate those investing principles that seemed obvious at first glance.

This article is simply an attempt to capture some of that "cliché" wisdom in one place.

1. "Stocks aren't lottery tickets. Behind every stock is a company. If the company does well, over time the stocks do well, and vice versa. You have to look at the company. That's what you research."

- Peter Lynch

Peter Lynch’s book One Up Wall Street is an absolute treat for anyone looking to get into the world of investing.

2. "Know your circle of competence, and stick within it. The size of that circle is not very important; knowing its boundaries, however, is vital.

- Warren Buffett

3. “It’s easy to borrow stock ideas. It’s very difficult to borrow stock conviction.”

Getting investing ideas from friends and family is easy. Having the ability to bet big on them is difficult. Betting on borrowed conviction is never ideal.

4. "Never ask anyone for their opinion, forecast, or recommendation. Just ask them what they have or don't have in their portfolio."

- Nassim Taleb

Skin in the Game matters. Are people actually willing to put their money where their mouth is? It almost always helps to think about incentives.

5. "We have no control over outcomes, but we can control the process. Of course, outcomes matter, but by focusing our attention on process, we maximize our chances of good outcomes."

- Michael Mauboussin

Michael Mauboussin beautifully touches on the impact of luck and skill in his book Success Equation. If you don’t have the time to read, consider checking out his Google talk on the same.

6. "It is a capital mistake to theorize before one has data. Insensibly one begins to twist facts to suit theories, instead of theories to suit facts."

- Arthur Conan Doyle (Sherlock Holmes)

Arthur Conan Doyle's famous quote highlights the importance of data and evidence-based thinking, rather than relying on assumptions and theories. This is particularly relevant when it comes to distinguishing between correlation and causation.

Correlation refers to the statistical relationship between two variables, where a change in one variable is associated with a change in another variable. However, correlation does not necessarily imply causation, which refers to a cause-and-effect relationship between two variables.

7. "Companies that have no debt can't go bankrupt”.

- Peter Lynch

The stories of LTCM, Enron, and General Electric serve as stark reminders of the dangers of overleveraging. While the details of each case differ, the common thread is that excessive debt can quickly spiral out of control and lead to catastrophic consequences. These cautionary tales have been well-documented and studied, yet overleverage still remains a persistent issue in the world of finance.

8. "The intrinsic value of an asset is determined by the cash flows you expect that asset to generate over its life and how uncertain you feel about these cash flows.

- Aswath Damodaran

If you are interested in valuation look no further than Professor Damodaran’s valuation course which is free and up on Youtube.

9. "Knowing what you don't know is more useful than being brilliant."

- Charlie Munger

Charlie Munger recognizes that there is much that we do not know and that acknowledging this fact can actually be more valuable than trying to appear knowledgeable or brilliant.

Munger is also a proponent of inversion, a mental model that involves focusing on the opposite of what you want to achieve. Inversion can be a helpful tool for investors because it can help identify potential risks or pitfalls that might not be immediately obvious.

10. “Keep an investing checklist. Before making any trade make sure you have ticked everything off that checklist.”

In his brilliant book “Checklist Manifesto”, Harvard Professor and surgeon Atul Gawande mentioned that despite all the complexity that surgery may require, small details like not washing your hands, not giving antibiotics at the right time, etc can be costly. He then talked about how having a succinct two-minute checklist actually helped reduce death in surgery. When surgeons with years and years of practice resort to checklists, it only makes sense that investors with far less practice in a field with far more luck, also resort to a checklist.

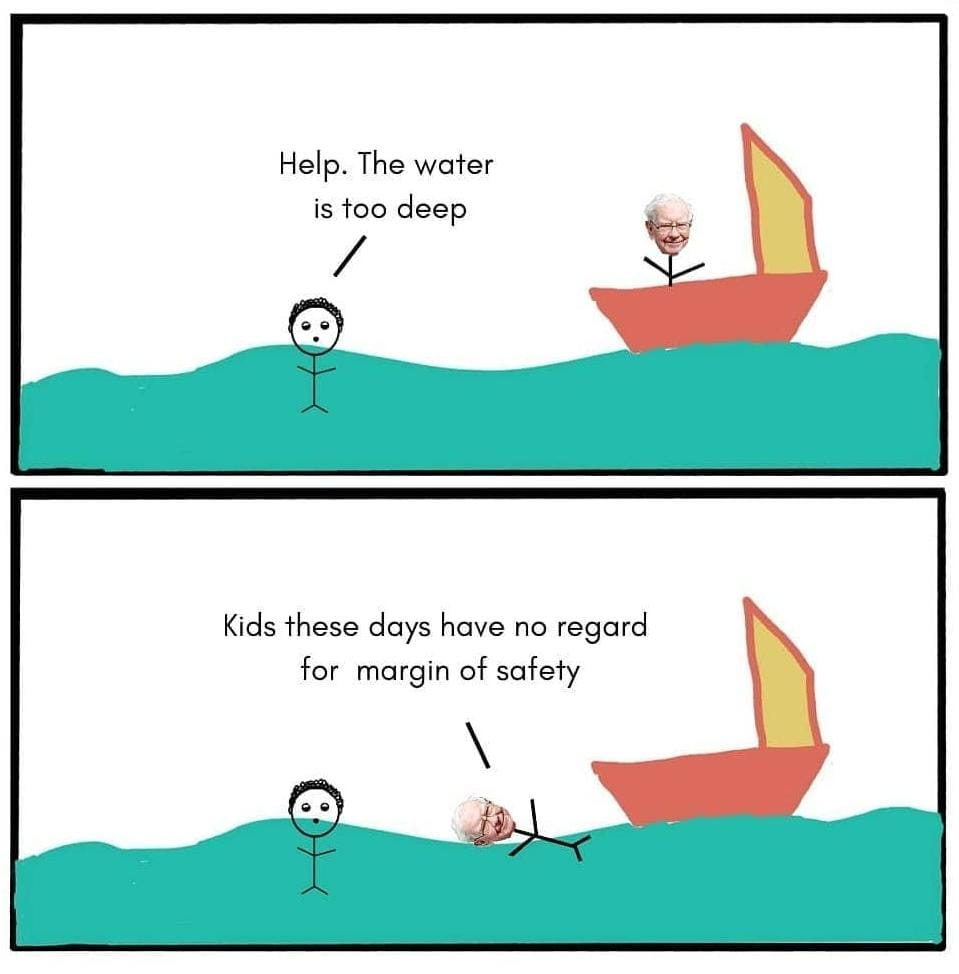

11. "A margin of safety is necessary because valuation is an imprecise art, the future is unpredictable, and investors are human and do make mistakes.

-Seth Klarman

12. "Most people overestimate what they can achieve in a year and underestimate what they can achieve in ten years."

- Bill Gates

This quote basically touches on our inability to understand exponential growth and our tendency to focus on instant gratification.

In the investing world, we often fail to understand the power of compounding. It’s easy to understand the impact of 20% returns for 1 year but understanding 20% for 20 straight years is where we make a mistake.

13. "Know what you own, and know why you own it

- Peter Lynch

To be able to analyze your decisions you need to know why you took them. Keep an investing journal. Record why you make a transaction. You can look back at this and see if the thesis played out. It prevents hindsight bias.

14. “Don't attribute profits to skill and losses to luck. Understand the role randomness plays in life and investing. Sit down. Be Humble”

- Kendrick Lamar and Taleb

If you have the reason why you bought a stock documented, you will be able to distinguish between solidd decision-making and luck.

15. "It's not whether you're right or wrong that's important, but how much money you make when you're right and how much you lose when you're wrong.

- George Soros

Position sizing plays a crucial role in investing. Additionally, it is always beneficial to consider risk-rewards and identify any disparities in the same.

16. "The most important thing to me is figuring out how big a moat there is around the business. What I love, of course, is a big castle and a big moat with piranhas and crocodiles."

- Warren Buffett

I recently co-wrote an exhaustive article on Moats using Hamilton Helmer’s Seven Power Framework. Consider checking it out.

The seven moats mentioned in the article are - scale, brands, network effects, cornered resources, counter positioning, process power, and switching costs.

17. Sustainable value creation has two dimensions: the magnitude of the spread between a company's return on invested capital and the cost of capital and how long it can maintain a positive spread."

- Michael Mauboussin

A moat is only useful if it gives a company the sustained ability to earn above its cost of capital.

18. “Risk can be defined as being the chance of permanent capital impairment. Meanwhile. uncertainty can be defined as not knowing what the future holds. Uncertainty is not always a bad thing.”

Mohnish Pabrai in his book Dhandho Investor touches on how low-risk but high uncertainty, can lead to opportunities in the market.

19. “The investor's chief problem-and his worst enemy is likely to be himself. In the end, how your investments behave is much less important than how you behave."

-Benjamin Graham

Investing is not just about understanding the market and the stocks we invest in, but also about understanding ourselves. It involves recognizing our biases and limitations. As Nassim Nicholas Taleb aptly puts it, "We should approach every meeting and every investment decision with the humble acknowledgment that we are fallible individuals, prone to mistakes and lacking complete knowledge, yet fortunate to possess the rare privilege of being aware of our own fallibility."

20. “First-level thinking says, 'It's a good company; let's buy the stock. ' Second-level thinking says, 'It's a good company, but everyone thinks it's a great company, and it's not. So the stock's overrated and overpriced; let's sell”.

- Howard Marks

Second-level thinking involves taking a deeper, more nuanced approach to investing. It goes beyond just looking at the numbers and considers what the market is already expecting from a stock. Second-level thinking requires you to ask yourself questions like:

What does the market already know about this company?

What are the market's expectations for this company?

Are those expectations reasonable, or are they too optimistic or pessimistic?

Once you have a better understanding of the market's expectations, you can make a more informed decision about whether to invest in a particular company. This is why reverse DCFs are so important.

Hope you enjoyed reading this. Consider subscribing, if you made it this far!