The Year in Trends?

The crazy financial markets

With the year coming to a close, let’s use Google Trends to take a quick look at some of the crazy stuff that may have impacted the markets in 2021.

January

How dare hedge funds ascertain what happens to a stock? At least that was the sentiment in January 2021 as retail investors on Reddit took it upon themselves to decide what happens to the GameStop stock. The stock price skyrocketed as the hedge fund managers who had shorted the stock felt the pain. For more on the short squeeze that occurred in January, head over to Wikipedia.

February

Semiconductors are a key component in everything from consumer electronics and appliances to automobiles and IT systems. Concerns around the semiconductor shortage were being voiced since the end of 2020. In February many automobile manufacturers announced that they won’t be meeting their targets and that is exactly what happened.

March

In March, the Suez Canal was blocked for six days after a ship got stuck. Close to 12% of global trade, around one million barrels of oil and roughly 8% of liquefied natural gas pass through the canal each day. (BBC) Not ideal to say the least.

April

Let’s not forget, how bad things had become due to the 2nd Covid Wave in India. Hospitals were running out of beds and Oxygen. The chart above shows the desperation that the country was going through.

May

From becoming the richest man on the planet to calling himself "Technoking of Tesla”, Elon Musk has had a hell of a year. His tweets have had a huge impact on the market. In March he Tweeted that one can now buy a Tesla with Bitcoin. In May he said that you can’t buy a Tesla with Bitcoin anymore due to environmental concerns.A Volatile ride for both Tesla and Bitcoin holders.

June

Coco-Cola was trending in June and not for the right reasons. Cristiano Ronaldo displayed his distaste for the soft drink by removing two bottles of Coke placed on the table before holding up a bottle of water. Sure enough, the memes followed.

(Source - Indian Express)

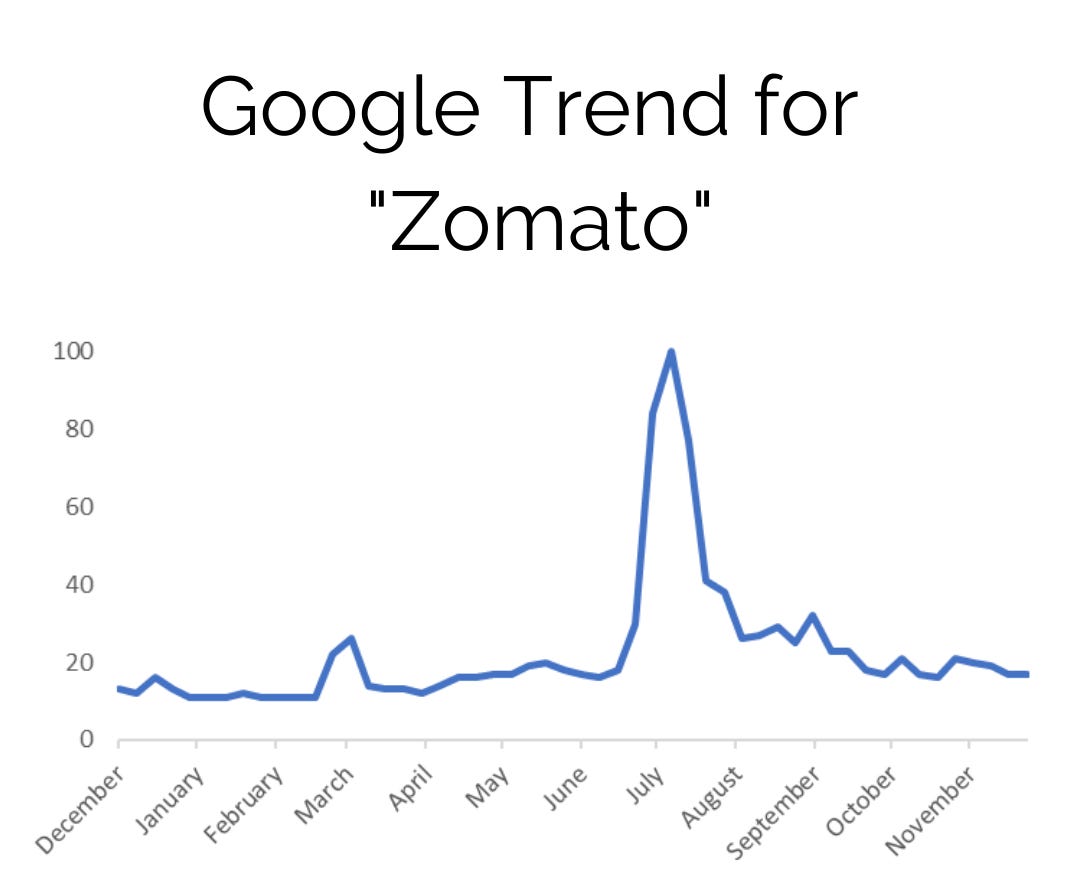

July

I would be remiss if I don’t touch on the plethora of IPOs that hit the Indian market. Zomato being one of the successful ones that listed at a 53% premium over the IPO issue price. Professor Damodaran had actually valued Zomato in July. Here is a link to his article.

August

After the US foreign forces withdrew from Afghanistan, the Taliban surged back to power in the country.

September

A Huge Chinese property developer borrowed a lot of money to grow, but then defaulted on its payments. Sounds fairly simple until you hear news about how this could impact the global markets and lead to a whole financial crisis. September was filled with news around Evergrande. To learn more about Evergrande here is a great thread by Sahil Bloom.

October

As Facebook decided to rebrand itself as “Meta” people around the world started searching about the Metaverse. Sign of things to come?

November

In November, the “Omnicom” variant acted as a reminder that Covid is still prevalent around us. Markets tanked globally and the Vix shot up. Is this pandemic ever going to end?

December

Okay, this is not specific to December but I could not talk about 2021 without touching on the impact that blockchain has had this year. I myself have done a fair share of googling to better understand Web 3.0, NFTs, DAOs, Tokens, and so on. The year has definitely brought decentralized finance into the limelight.

So what did you learn this year? Anything that made you a better investor? I for one have a greater appreciation for the fact that modeling stuff in the short run is damn near impossible!

Here’s hoping for a better 2022! Thanks for reading.