What 50 years of returns tell us about gold

Gold is in the news again, and why wouldn’t it be? From October 1, 2024, to October 1, 2025, the metal has delivered returns of around 46% in USD and roughly 54% in INR.

Crazy, right ?

The narrative behind this surge is familiar by now. General uncertainty across the world, America’s widening fiscal deficit, and central banks steadily adding gold to their reserves may all have played a part.

Whatever the case, the returns over the year are remarkable. But before getting carried away by the headlines, it is worth remembering that gold’s journey has not always been this smooth or one directional.

From February 1, 1975 to October 1, 2025, the CAGR stands at 6.38% in USD terms. That is over nearly five decades. Respectable, no doubt, but it still does not tell us the full story.

Which is why it is always worth looking at rolling returns. I specifically focus on one-year, five-year, and ten-year holding periods. To calculate rolling returns, we look at how much an investor would have earned if they had bought gold at the start of any given month and sold it after one year, five years, or ten years. Doing this for every possible month over the past five decades gives a clearer picture of how often gold has actually made or lost money over different time horizons.

Between 1975 and 2025, if you invested in gold on the first day of any random month and held it for one year, the odds of losing money were around 41%. That probability falls to 33% if you invested for 5 years and 27% over ten years.

I then examine the 25th to 75th percentile of the rolling returns across the same three time periods. This range captures the middle half of all outcomes, showing us what a typical experience for investors has looked like, without being skewed by extreme highs or lows.

Three things stand out to me in that chart.

The range of outcomes narrows as the investment period lengthens. This is common and seen in equities as well. Longer holding periods tend to smooth out short-term volatility.

In the last fifty years, you could have invested in gold for a decade and still see no return in dollar terms. This is not an outlier. In fact, it falls around the 25th percentile when we look at gold’s performance over the last fifty years, which is quite sobering. You could argue that we live in different times and this may not repeat, but the data is there for everyone to see.

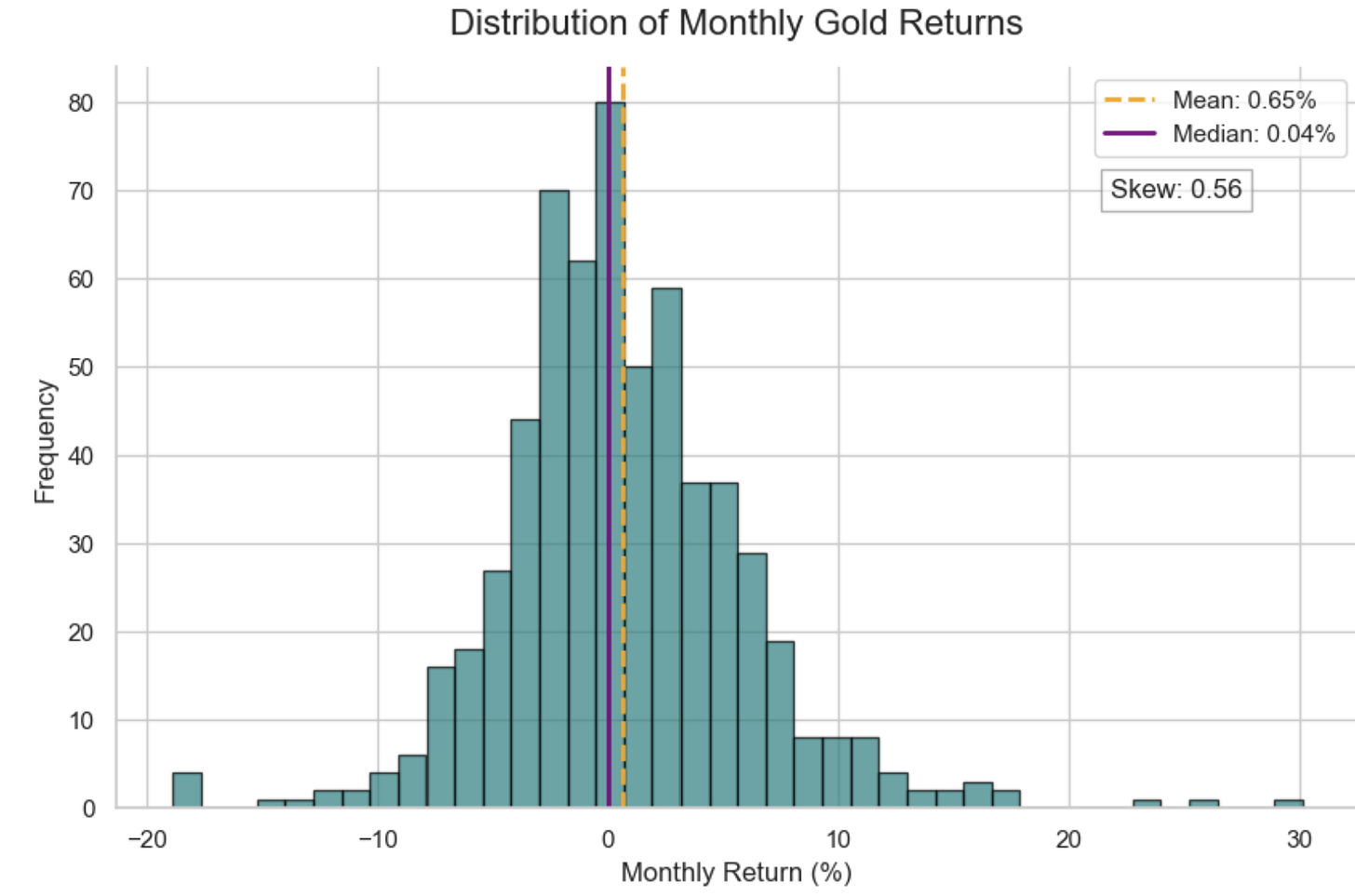

The median gold return is consistently lower than the long-term CAGR of around 6 percent. This suggests that gold’s return distribution is skewed, with a few strong periods pulling up the average while the typical experience has been more modest. The chart below demonstrates the same.

I belong to the Aswath Damodaran school of thought, where if an asset cannot generate cash flows, it's hard to value. So, I don’t know what gold is worth, and I won’t pretend to know what it could be worth.

But if the question is whether gold deserves a place in a portfolio, I do have a personal view on that. Yes it does. Certainly for me.

Gold is an asset that is easy to buy and has consistently shown low correlation with equities, which is always handy when building a portfolio. Its long-term returns aren’t bad, and the fact that it tends to hold up well during uncertain periods is an added bonus.

Having said all that we shouldn’t ignore the fact that it can go through long periods of underperformance. Will I bet the kitchen sink on gold? Absolutely not. Will it be a small part of my portfolio? Yes. Should you buy gold now? No clue. I’m not an expert and have no idea what lies ahead.

That’s all for now. Thanks for reading.

If you liked what you read, and want to support the page, consider exploring the Value Tortoise Investment Journal. Its a resource designed to minimize biases while investing.

Disclaimer: This is not investment advice. These views are personal and should not be construed as recommendations or guidance for any investment decisions. I have made every effort to ensure that the data and calculations presented are accurate, but errors may occur and past performance is not indicative of future results. Readers should do their own research and consult a professional before making any investment decisions.

Cover image taken from Unsplash

Thanks for the write-up. I also can’t value gold, so I don’t own an of it in my portfolio. If you want to park some part of your portfolio in non-equity correlated assets, why not choose liquid funds (or bonds) which would yield 6-7% annually rather than gold which has random fluctuations?